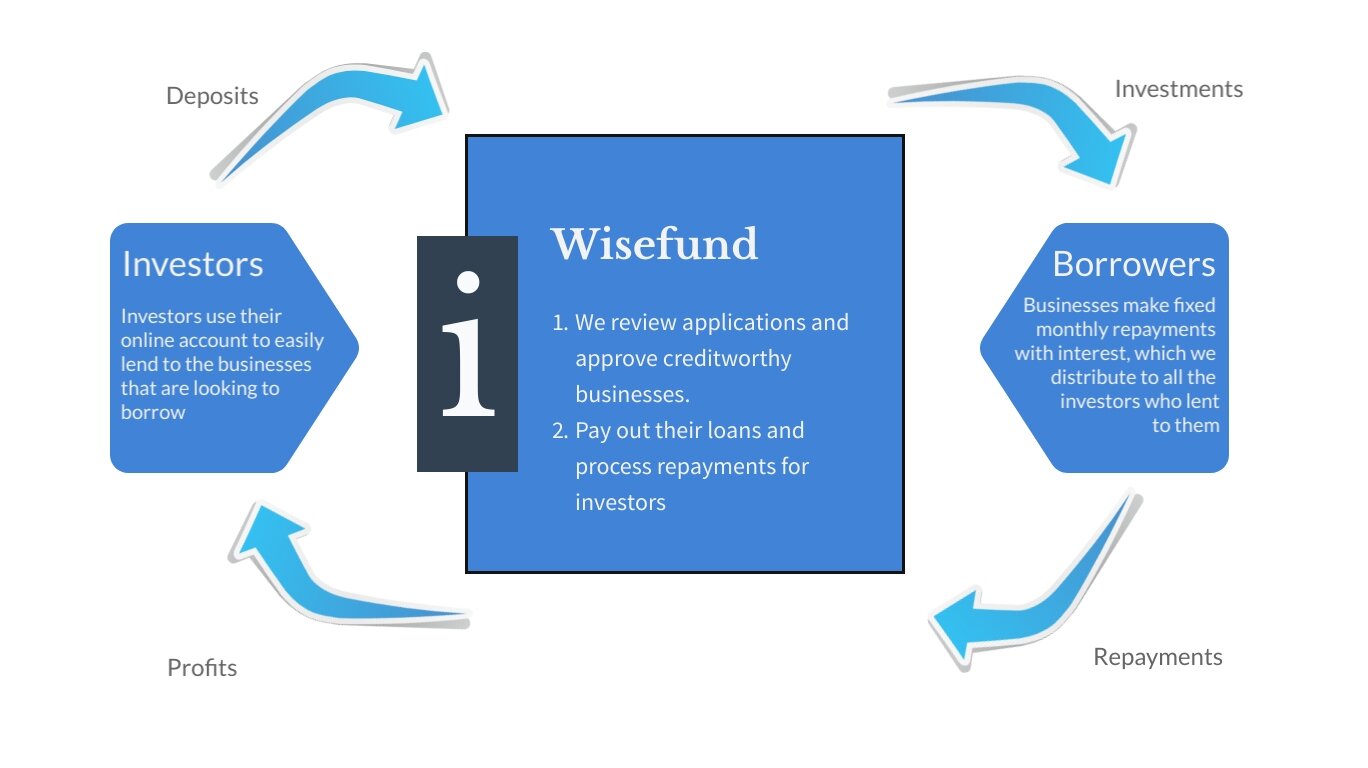

Using technology to eliminate the middleman, Wisefund brings lender and borrower relationships back to basics: ordinary people ready to invest can connect and lend to trustworthy businesses that wish to borrow.

Wisefund offers all the savers the reassurance that their savings will earn high, regular and steady returns. Wisefund is where businesses can obtain necessary funding without the hassle that can stifle growth.

In the end, as businesses succeed, value is added, not only interest rates. Value builds the future!

Through high returns, we offer the potential to double your initial investment within 6-8 years (or sooner), depending on the risks you take. Everything from that point is a bonus and a clear path towards financial freedom.

It’s never too late to build your financial freedom!

How your money is managed

Deposits ->

Upon completed registration you deposit funds to the platform. Deposit details are available on your investment account

-> Investment account

Your funds are reflected on your investment account - a flexible, straightforward account where you are in control of your funds

Invest ->

As soon as you invest in loans and the loan is fully funded, the borrower enters into the agreement with you and the platform and receives the actual funds of the loan

-> Commission

There are no fees for investors when investing. The borrower covers the commission of a fully funded loan which is used to fund platform's operations

Interest payments ->

Borrower makes monthly interest repayments, which are immediately credited to your investment account

-> Principal repayment

Borrower repays the loan at the end of loan term. The principal is immediately credited to your investment account

Invest again or withdraw

All funds received on the investment account, either interest or principal repayments are immediately available for withdrawal or further investments.

Segrageted client funds

All funds that are deposited prior to transferring them to the funded project owner are held at a segregated client funds account separated from Wisefund own operations.

Borrower Acceptance Policy

For the purpose of understanding the process of how Wisefund accepts borrowers before listing them to fund their loan requests, please see insight of the process that has been integrated with Wisefund as its Borrower acceptance policy from the very beginning of the operations, with improvements over each new case.

There are certain procedures that borrowers go through before they get accepted for the listing.

1) Application letter received from the Borrower.

2) The Portal conducts prima facie check of the Borrower per the publicly available information.

3) Postal offers Fee Schedule to the Borrower, and if agreed upon, further Due Diligence is performed.

4) After we determine that a applied project is a good fit, we kick-off the formal due diligence process. We review each applicants pitch deck, conduct screening calls, and complete independent research to better understand the business and, if necessary, tap into our networks to help us evaluate the following factors:

- Business model - How does the business make or intend to make money? How much can it make? Will current funding be enough?

- Market - How large or disruptive can this business be? What advantages do they have over their competitors? Is the project capable of living?

- Uniqueness - How is modern technology and approaches used in the business? What problem and how they are solving? Is it unique or difficult to replicate?

- Team - CVs, UBO information, does the team have the right people with appropriate background?

- Fact checking - Is the information presented in the pitch true? We verify key facts, contracts, records. As businesses are EU based this information is widely available through various business registers.

- Eligibility and durability - Does the project, idea and business itself have enough runway to survive without this campaign? Are the funding goals reasonable? Why specifically this funding source was selected? What are main risks behind the business/project? We do a thorough financial and legal review, and run background checks on founders and officers. All companies must be EU-based.

- List of liabilities due in the next 12-18 months?

- Preferably, Letter of good standing from a their bank and/or business partners

- Absence of tax debts.

5) Final decision. After completing our due diligence, we will decide whether to offer the company the opportunity to raise on Wisefund. Once the proper documentation is prepared, the project will go live on Wisefund with its loan offer for funding, where we will continue to monitor the campaign and help educate and inform investors if necessary.

6) Funding at 100% The Loan is issued only after it is 100% funded. Though if the business model allows, rounds may be closed earlier, to issue funding to the business for quicker turnaround, opening other rounds for further funding.

7) Borrower reports to the Portal on the performance of the project, the utilization of the lent amount based on the purpose of the loan either upon request, quarterly or monthly – all depends on the loan terms

For any questions regarding borrower acceptance policy, please reach out to Wisefund Support.

What do we guarantee

Wisefund believes the people who entrust their money deserve to feel safe about it. What Wisefund does and guarantees, we do a thorough work to evaluate each of the application very carefully checking borrowers and team behind the project both, through legal and financial aspects.

Loan offers presented on Wisefund provide high interest rate offers and contain certain amount of risk of project behind the loan being unsuccessful. Borrowers listed with loan offers on Wisefund usually provide less guarantees than in the case with bank loans thus being unsecured business loans, whereas usually there are certain guarantees behind each project. Commercial pledge on shares extending the value of the loan and personal guarantees by UBO or CEO is a part of additional guarantee Wisefund may take from the borrowers to add extra layer of security for our investing customers. To confirm those securities there are plenty of open registers available as most of businesses financed through Wisefund are Europe based. Although, our customers may request additional information on each loan through our support channel. Note: pledges and securities are usually established once the loan offer is fully funded and certainly before the issue of the loan to the borrower. It may be also common for Wisefund to acquire blocking shareholding rights in the borrowing business for the duration of the loan to get additional control of the loan use and exclude actions of the borrowers that may result in decreasing the value of assets pledged.

Investors earn

18.32%

per year on average

* Please note that the type of security, for example, personal guarantee, mortgage, and its LTV, commercial pledge guarantees, etc, all are specified for each project individually in the project description as well as your loan agreement. Refer to your loan agreement and project description for more details.

*Wisefund is not covered by the Deposit Guarantee Scheme or the Investor Compensation Scheme in Estonia.

* WARNING: Your returns may be lower than expected. Past performance is not indicative of future results. If you lend to businesses on Wisefund you may lose some or all of the money you invest.